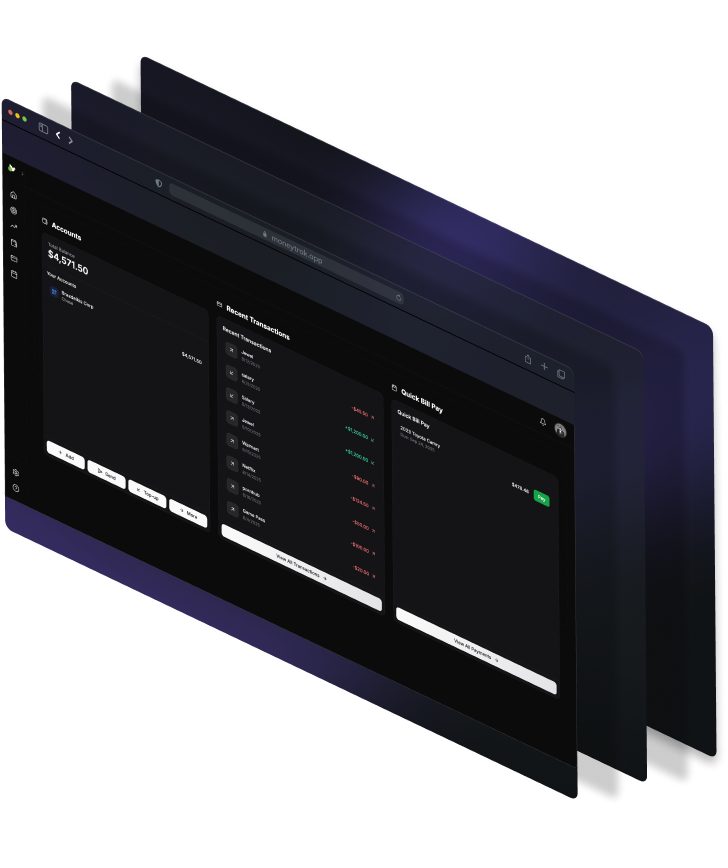

MAKE SMARTER DECISIONS, EASIER

Your Money.Your Insights.Your Growth.

MoneyTrak helps you understand your finances clearly so you can focus on what matters most. Track spending, manage goals, simplify your finances, all in one place. No more cluttered spreadsheets.

Smart Analytics

Visualize your spending patterns with intelligent insights. MoneyTrak analyzes your financial data to provide actionable recommendations.

Bank Sync

Connect multiple accounts securely. Real-time synchronization keeps your financial data current across all your banking relationships.

Client-Side Encryption

Your data stays private with end-to-end encryption. MoneyTrak ensures your financial information never leaves your device unencrypted.

Budget Tracking

Set and monitor budgets effortlessly. Smart categorization and spending alerts help you stay on track with your financial goals.

Multi-Account Management

Manage checking, savings, and investment accounts in one place. Unified dashboard provides complete financial overview.

Goal Setting

Create and track financial milestones. Visual progress tracking and automated savings recommendations keep you motivated.

"MoneyTrak took the stress out of managing our finances. Instead of juggling spreadsheets, we now see everything in one place and actually enjoy keeping track of our money."

Basic

Pro Plan

per month

Frequently Asked Questions

Everything you need to know about MoneyTrak and how it can transform your financial management